How did a company known for powering video games become the backbone of artificial intelligence?

Nvidia’s rise from GPU maker to trillion-dollar AI juggernaut isn’t just a business story. It’s a masterclass in vision, timing, and calculated risk. In 2025, Nvidia isn’t just valuable—it’s essential. With over 80% of the AI chip market, the company is the silent force behind every modern AI application—from ChatGPT to autonomous factories.

Let’s dive into the reasons behind this extraordinary transformation.

🧬 A Timeline of Reinvention: Nvidia’s Evolution in a Decade

The CUDA Bet (2006)

Nvidia’s transformation began in 2006 with the launch of CUDA (Compute Unified Device Architecture). At the time, using GPUs for general computing seemed far-fetched. Wall Street ignored it. For a decade, CUDA was worth nothing on the company’s books.

Now? It’s the foundation of Nvidia’s AI empire.

The RTX Revolution (2018)

Following the 2017 boom in neural networks, Nvidia released the GeForce RTX series. These GPUs came with dedicated AI cores (Tensor Cores), pushing the limits of both graphics and machine learning performance.

Generative AI: The Catalyst

When large language models exploded onto the scene in 2023–2024, Nvidia’s chips were already years ahead. By the time enterprises realized they needed AI compute, Nvidia had already cornered the market.

📊 2025 in Numbers: The Nvidia Boom

- 💰 Market Cap: $3.46 Trillion

- 📈 2024 Revenue: $130.5B (up 114% YoY)

- 🧠 AI Chip Market Share: Over 80%

- 🏗 Planned Investment in U.S. AI Infrastructure: $500B over 4 years

- 📦 Data Center Revenue Growth (Q1 2025): +73%

- 💹 Stock Growth (2020–2025): +1,433%

🏗 The AI Infrastructure Company

Nvidia isn’t just selling chips—it’s building the future of AI infrastructure.

Strategic Moves:

- 🤝 Tight alliance with TSMC ensures priority production.

- 🏢 Plans for a global HQ in Taipei signal commitment to Asia.

- 🌍 Deals with Europe and the Middle East reinforce Nvidia’s role as an AI enabler.

- 🔬 R&D lead spans several years ahead of competitors.

🆚 AMD and Huawei: Are There Real Contenders?

AMD’s Challenge

AMD has unveiled the Instinct MI400 series, promising a 10x boost in inference performance over previous generations. Its upcoming Helios rack aims to serve hyperscale data centers.

However, Nvidia still dominates in developer ecosystem, software stack (CUDA), and brand trust.

Huawei’s Play

Huawei’s domestic progress in China—thanks in part to U.S. export restrictions on Nvidia—gives it a foothold in the East. But globally, it’s not a real threat—yet.

💡 Why Nvidia Is Unstoppable (For Now)

1. It Owns the Ecosystem

From hardware to software (CUDA), Nvidia controls the full AI stack.

2. It Makes the Economics Work

$1 spent on GPUs can generate up to $10 in AI application revenue, mirroring cloud computing ROI logic.

3. It Saw the Future First

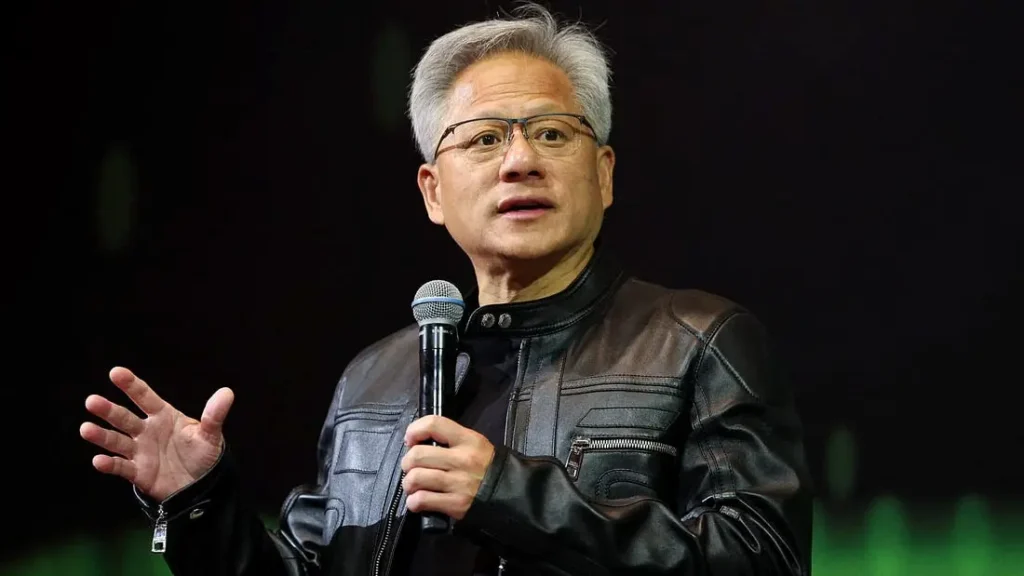

While others debated the future of AI, Jensen Huang invested in it. Now the world runs on his chips.

🌎 AI Will Be Bigger Than the Cloud

If cloud computing was the “startup boom” of the 2010s, AI is the industrial revolution of the 2020s.

- Cloud revenue grew 30x between 2011–2024.

- TSMC’s AI chip revenue is projected to grow 6.2x by 2029.

- Nvidia’s data center revenue will quadruple in that time.

In simple terms: the infrastructure for AI will be bigger, faster, and more critical than anything before it.

🔮 The $4 Trillion Question

Could Nvidia become the first $4T company?

Many analysts believe so. With AI becoming as indispensable as electricity, and Nvidia at the center of it all, it’s less a question of “if” and more of “when.”

And if you’re asking whether we’re in a bubble—remember what people said about Amazon, Google, and the cloud 15 years ago.

AI isn’t just a trend—it’s a new economic layer. And Nvidia is the infrastructure behind it.

Want to understand where tech is going? Follow the chips. And for now, all roads lead to Nvidia.